Today we’d like to introduce you to Andrew Clarke.

Hi Andrew, can you start by introducing yourself? We’d love to learn more about how you got to where you are today?

I’m on a mission to financially empower adults with skills for creating generational wealth. These skills are needed NOW more than ever! My story is a testament to the power of these skills.

Growing up, I watched my mom work over 100 hours per week for years. She did this to support our internal family and relatives back in Jamaica who couldn’t support themselves.

I was concerned for her health as most nights she slept less than 4 hours. So, at 15 years old, that motivated me to start self-educating myself on how money worked. I realized how important real estate was and my mom did too! She became a real estate agent and shortly after she bought her first rental property.

By 18 years old, while going to college for my bachelor’s degree in Biomedical Engineering, I joined her and worked part-time as a licensed real estate agent. Unfortunately, the market crashed the very next year. I eventually gave my license up, so I could focus on school. However, I never stopped learning! It was during that time that I started to learn A LOT about investing in real estate. I also got in-depth training on how to manage money, debt, and credit. I realized later how crucial mastering those 3 would be throughout life, not just in real estate. Sometimes it’s not that we don’t have enough money, it’s that we don’t understand how to manage the money we do have.

After graduating, I found my dream job as a software consultant with a very small company. They had only 10 employees. However, they had BIG ambitions. I believed in the owner’s vision and wanted to be part of their journey. And the coolest part was that with this job I’d get to do one of my favorite things, which is to travel! Except, there was one MAJOR problem. What they could pay me was 18% less than the average graduate with my degree, which was what I expected to get. However, after praying about it, I decided to move in faith and I accepted the offer.

Fortunately, the financial training I had helped me achieve my biggest goal at the time. I was able to find ways to drastically cut my expenses. This allowed me to save up enough to buy my first investment property the week of my 24th birthday. That was only 9 months after graduating from college. I then focused on paying off bad debt, including money used to renovate my duplex and my student loans. I was able to pay both off 2 years later! The combination of owning an investment property in my early twenties and paying off bad debt quickly laid a strong financial foundation for me. This helped me to get into other investments such as stocks and even private equity investments.

Fast forward to the spring of 2020, Covid-19 hits, and I had already been looking at statistics showing that more and more people were living paycheck to paycheck every year, the cost of living was going up significantly, and college tuition was rising much faster than the average household income.

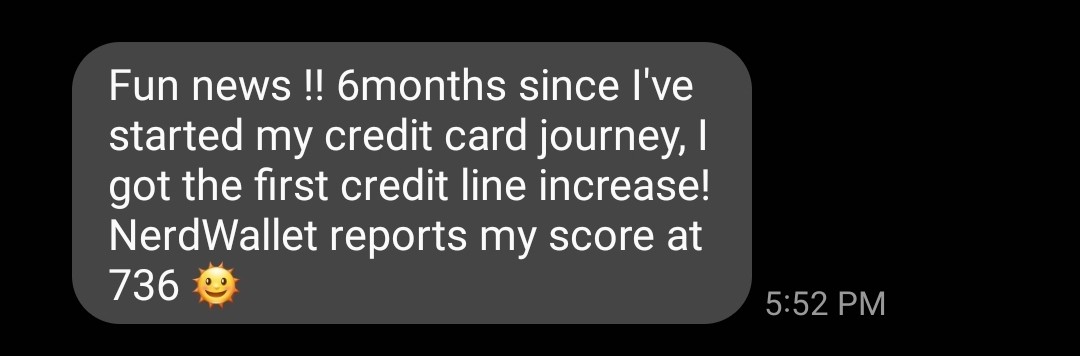

And of course, Covid-19 showed up and made everything MUCH WORSE. Little had changed in terms of school providing the financial education that would transform lives, so I decided to do something about it by starting Expanding Wallet. I published the first article on the Expanding Wallet website in September of 2020. I recently launched my first online financial course for future homeowners! I help future homeowners master money, so they can save thousands on their first home. My goal is to help my students save a combined $1,000,000.00 this year. It’s very exciting to hear their financial success stories!

I’m sure you wouldn’t say it’s been obstacle free, but so far would you say the journey has been a fairly smooth road?

No, it has not always been an easy road. However, I never expected it to be easy. Before starting Expanding Wallet, I knew I’d have to face one of my greatest fears, public speaking. I needed to be comfortable speaking in front of crowds, both in person and virtually, to do what I had planned for Expanding Wallet. Fortunately for me, 10 months before launching Expanding Wallet, I unexpectedly met and became friends with Deirdre Van Nest. Deirdre is a top-rated international keynote speaker and a speaking coach to high-performing financial professionals. When I found out what she did for a living, I told her one day, I would be one of her students. Seven months later, I called her and told her I was ready to be her student. She not only helped me believe in myself as a speaker, but she showed me the finer details of speech writing. That really helped me when I did my first live workshop.

I also started working with one more speaking coach that year, Mr. Les Brown. Yes, the Les Brown, one of the greatest motivational speakers in history! In Les’s program, we focused heavily on delivery when you speak. I got a ton of practice speaking to inspire, which I love doing. I even did a 3 minutes speech in his course in front of over 200 students from around the world. Some students even messaged me and said my speech was so good that it made them cry. I’ll never forget that night!

I believe that God put both Deirdre Van Nest and Mr. Les Brown in my life to train me so that I could transform lives. I’m forever grateful.

As you know, we’re big fans of Expanding Wallet. For our readers who might not be as familiar what can you tell them about the brand?

Many people not only lack knowledge when it comes to managing money but they also don’t have a system to help them make crucial financial decisions. The Expanding Wallet course for future homeowners solves those problems. When students have both knowledge and a system to use, they maximize their savings ability. The course is all online and is a combination of self-directed learning and live training. The best part is students can finish the course in 3 months or less. Financial freedom starts with financial education.

Where do you see things going in the next 5-10 years?

As the cost of living continues to increase, the need to be financially savvy will increase as well. As a result, I see the demand for financial education growing significantly, especially via online courses. Online courses are more affordable than in-person courses because of the lower overhead cost. This makes them a more viable option for someone struggling financially.

Contact Info:

- Email: [email protected]

- Website: https://expandingwallet.com/

- Instagram: https://www.instagram.com/expandingwallet/

- Youtube: https://go.expandingwallet.com/youtube/channel/EWsubscribe

Laura Pence Atencio

May 25, 2022 at 4:14 pm

Congratulations on your success, Andrew! Your journey is truly inspiring. I love that you are reaching back to educate others and lift them up, too. You are the best of us.

Andrew Clarke

June 8, 2022 at 11:51 am

Thank you Laura! I appreciate your kind words. It brings me joy to help others transform their lives.